💰 How to grow your savings in Norway: bank deposits, ASK accounts and IPS pensions (2025 guide)

Once you have saved up some money using our tips, it's a good idea to invest it. In Norway, investors have access to a wide range of tools. These include guaranteed deposits of 3–4% and tax-free stock accounts (Aksjesparekonto, ASK) and pension accounts (IPS), which immediately reduce taxes by 22%. Below are ten practical questions on how to divide your kroner into baskets without unnecessary fees and avoid being blocked by the tax authorities.

🏦 What is the current interest rate for a regular bank deposit?

The best 'high-interest account' in July 2025 is Kron Collector Bank, which pays 3.9% interest per year (minimum 25,000 kr, but you can't withdraw your money for 31 days). DNB 'Sparekonto Pluss' — 3.4% interest for balances over 200,000 kr; you can withdraw your money straight away, but there is a 0.5% charge for the third withdrawal you make per month. Bankenes Sikringsfond protects deposits of up to 2 million kr. A 22% tax is taken out automatically, leaving a net income of 3.04%. It's perfect for setting up an emergency fund that will last for six months. But over time, inflation (which is 2.8%) will actually reduce the profit.

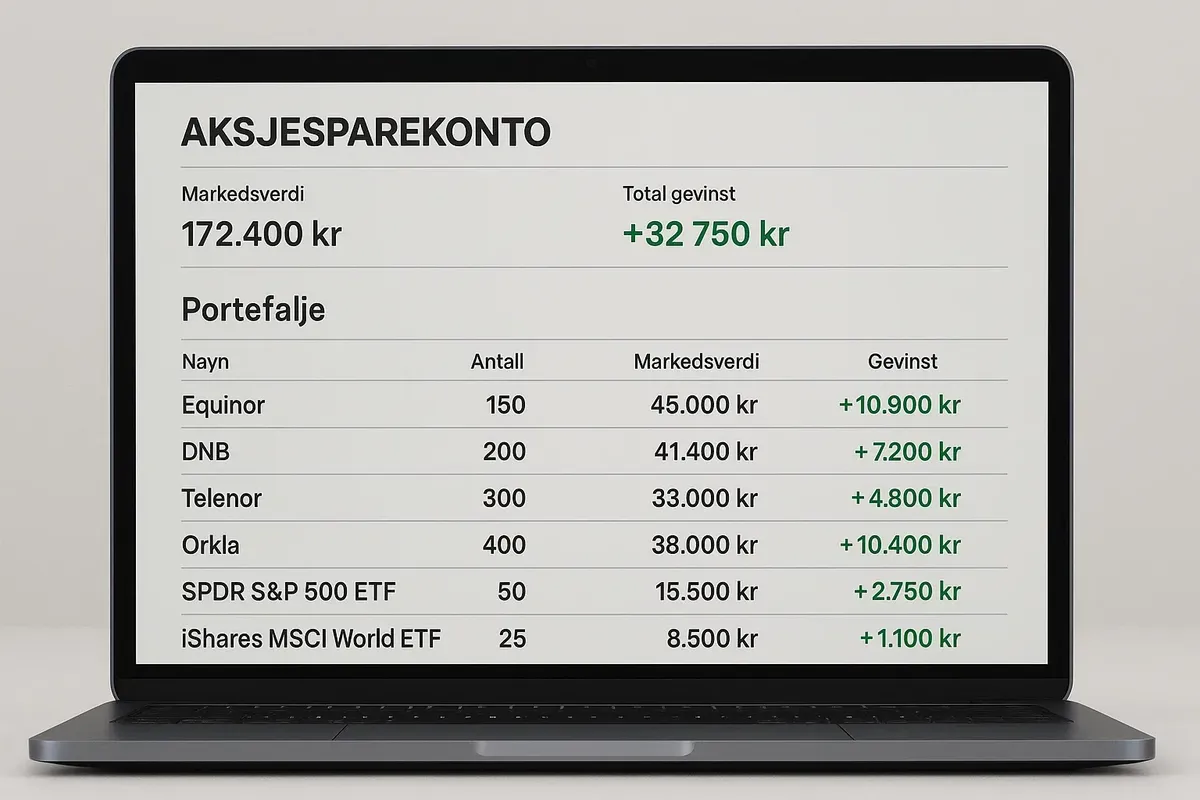

📊 How does Aksjesparekonto work and why is it tax deferred?

ASK lets you buy shares and ETFs in the EEA without paying tax until you take out more money than you put in. Imagine you put 100,000 kr into an investment. If the value goes up to 130,000 kr, and you take out 100,000 kr, you won't have to pay 22% tax because you're just taking your own money back out. The money made in the account doesn't have tax taken off, and the snowball effect makes growth faster. Commissions: Nordnet: no charge for opening an account and no charge for transactions.

DNB: no charge for maintenance and 0.04% charge for trading. The only problem is that you can only invest in shares and funds; you cannot invest in bonds or crypto.

📑 What will the new Fondskonto offer after the 2024 reform?

Fondskonto (formerly Unit Linked) now has tax deferral until withdrawal, but a 22% tax on all profits when you take your profits out. The bank charges a 0.1% insurance fee and a 0.25% admin fee. What's more, you can hold bonds and funds in the same account. With a time frame of less than five years and a bond share of more than 40%, Fondskonto is better than ASK. The problem is that if you go bankrupt, the insurance only covers 200,000 kr (not 2 million).

👵 What are the advantages of a pension IPS, and who should use it?

You can save up to 15,000 kr a year on tax by putting it into your pension savings. This means you will save 3,300 kr (22%) in tax. The money is frozen until you reach 62, and any withdrawals are taxed at 22%. This is effectively a 'free loan' from the state tax. If your profit margin in ENK is 30%, the tax burden stays the same. IPS reduces the 'grundlag trinnskatt'. For young people with mortgages, the most important thing is to pay off the loan; it is a good idea to invest in IPS when the deposit rate is lower than the investment return.

📊 Can you invest in American ETFs, and what are the tax rules?

This is legal, but not tax-privileged, through Interactive Brokers with an EEA passport. The US withholds 15% of dividends, plus 22% for Norway, which is counted as credit. If you sell something, you have to pay 22% tax on the profit. This is called 'capital gains tax'. You have to write it down on form Skattemelding, section 3.1.8. From 2025, Finanstilsynet has reminded people that if they don't report transactions, they will be fined 40%. ASK does not support U.S. ETFs, so popular QQQ/SPY lose their tax benefits.

🌱 What are 'Grønne obligationer' and are they worth buying?

The Nordea Green Bond Fund invests in bonds that support environmental, social and governance (ESG) projects. Over the past 12 months, these bonds have provided a return of 4.2%. The commission is 0.35%. The risk is lower than with stocks and higher than with deposits. For ASK accounts, there is currently no tax, which is good news for people who are conservative. The problem is liquidity: some securities are sold once a week.

🤝 Crowdfunding Monio and Kameo: you could get a return of 8–10%, but what's the catch?

The platforms finance construction projects at 7–12%. Deposits start at 1,000 kr, but there is no fund guarantee. The default rate is 2.1%, and collateral is required. There is a 22% tax on interest, and the declaration is 'post 3.1.2'. The problem is that there is not much liquidity: money is locked in for 12–24 months. Don't invest more than 10% of your portfolio at any one time.

💻 How is cryptocurrency tax calculated and what are the fees?

Crypto is seen as a way to make money, and is taxed at 22% on any profit made. This is part of the rules in section 3.1.12. The Firi (0.07% fee) and Kraken exchanges let you export your data as a CSV file, which you can then use with Koinly. If you don't declare, Skatteetaten can ask for your data and you'll be charged 30–60% of the total plus interest. From July 2025, anonymous trading will be illegal in Norway: KYC for all amounts. If you store on a hardware wallet, write the value on 31 December as 'formue' (1% tax if total > 1.7 million).

⚖️ What's the best way to avoid paying double commissions for ETFs and funds?

Choose passive Norske Indeks-fond: DNB Global Indeks charges 0.18% and KLP AksjeVerden charges 0.17%. The composition is similar to MSCI, and it costs 80% less than active funds. If you invest 50,000 kr, you'll get an extra 0.8 p.p. That's 400 kr more each year, or 8,000 kr over 15 years. Buy Nordnet 'noll-provision' shares for the first 1,500 kr/month.

📂 What should you do with 100,000 kr?

Cushion:

- You can get 30,000 kr in Kron Sparekonto 3.9% — that means you have money available to use and it's guaranteed.

- The investment is expected to grow by 50,000 kr.

- The ASK is 70% KLP AksjeVerden and 30% Nordea Green Bond.The expected return is 6% before tax.

- Another option is to invest 20,000 kr Monio at 8% — this is a way to spread your money by using collateral.

The 10-year forecast (6%/3.9%/8%, reinvestment) shows that the capital is about 183,000 kr, and the net tax adjustment is around +63%. The risk is moderate, liquidity is protected, and taxes are optimised.

Investing in Norway is easy if you understand three rules: (1) use tax 'envelopes' (ASK, IPS) — they double the interest; (2) know the fees — a half-percent fee today can amount to thousands of kroner tomorrow; (3) balance liquidity, growth and risk. So, if you save 100,000 kr by being smart with your money, in 10 years you'll have 6 months of travel around the fjords or the money to put down on your own Arctic cabin. Make every krone work as hard as you enjoy Norway!

2 comments

Log in to leave a comment

Hva er det viktigste tipset for nye innbyggere som vil få mest ut av sparingen sin? 🏦