💰 How not to overpay Skatteetaten: personal taxes and refunds in Norway (2025 guide)

The Norwegian Tax Administration is really transparent, which is great, but if you enter the wrong details on your Skattekort, it can freeze tens of thousands of kroner. In this guide, we'll take a look at the ten most important questions people have about personal taxes in 2025. We'll cover everything from the basic rate of 22% to the tricky stuff, like deductions for mortgage interest and commuting. Don't worry, we've made it super easy to understand! Each answer is just 100 words long, so you'll always know exactly where to save money legally and when to expect a refund.

📈 What is the basic tax rate and what is trinnskatt?

In Norway, income tax is a bit like a warm hug for your wallet! It's a flat rate of 22% (alminnelig inntekt) and a 'stepped' surcharge called trinnskatt. Hey, just so you know, in 2025, the thresholds will be as follows: For amounts between 0 and 237,900, the percentage is 0%. For amounts between 237,901 and 671,100, the percentage is 1.7%. For amounts between 671,101 and 1,092,150, the percentage is 4.0%. For amounts between 1,092,151 and 2,174,350, the percentage is 13.6%. And for amounts above 2,174,350, the percentage is 16.6%. We just want to let you know that an extra trygdeavgift (pension fund) is deducted: 8.2% for employees and 11.2% for the self-employed. The three-part formula is really effective, with most employees seeing rates of 27-34%.

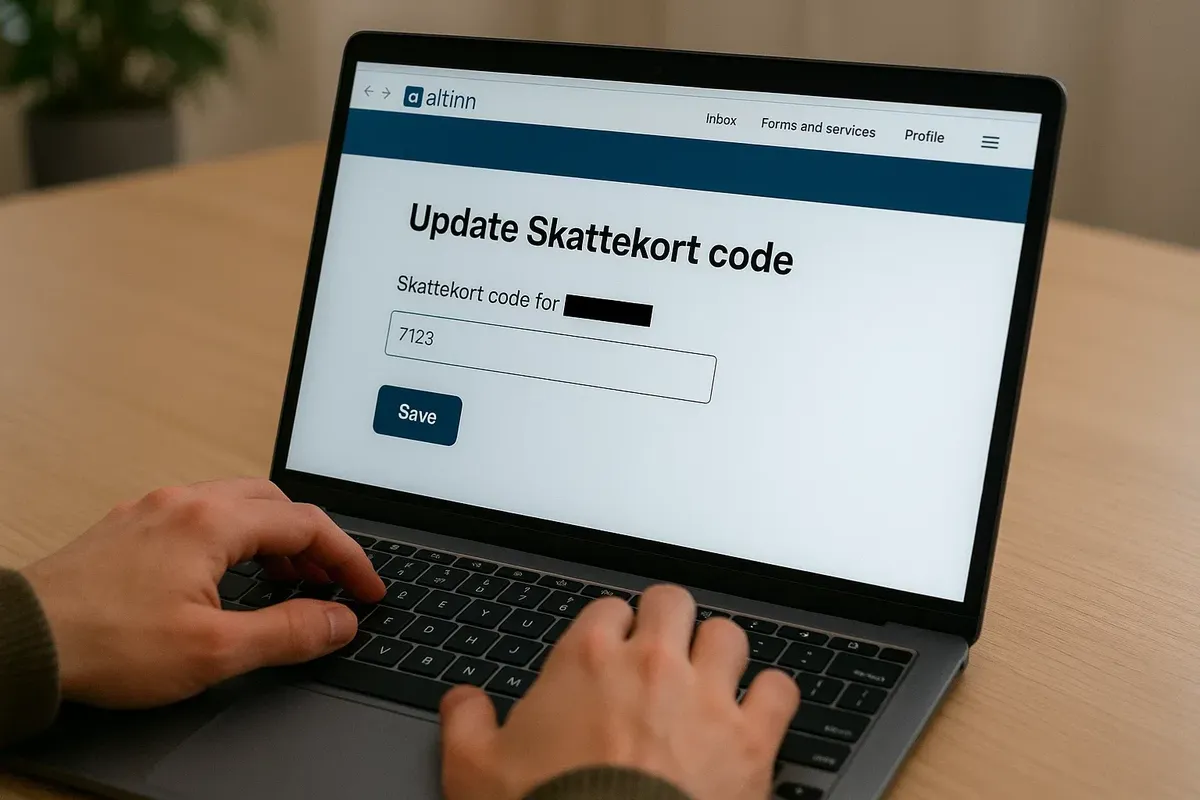

🧾 Why do you need the correct Skattekort code and how can you change it?

Skattekort is an electronic 'card' with your tax code. Don't worry if your employer has received code 7100 instead of 7102 (resident). They're just withholding 50% of 'fictitious' taxes. Don't worry, it's really easy to fix! Just go to Altinn, select 'Endre skattekort' and then update your income, loan interest and expenses. Rest assured that the new code will be sent to your employer within 24 hours, and the extra money will be returned in the June tax return. If you ignore the error, the state will just give you an interest-free 'loan' for a whole year.

🏠 How to get back mortgage interest (renter på lån)?

I'm really pleased to tell you that 100% of the mortgage interest paid during the year is deducted from the 22% tax base. Hey, just so you know, if you paid the bank NOK 82,000, you'll get a sweet savings of NOK 18,040! Don't worry, the bank will take care of the interest and automatically transfer it to Skatteetaten for you. Just check your Skattemelding – you'll find the amount in section 3.3.1. If you have a loan from Coop Boliglån that you haven't reported yet, you can add it yourself by attaching the bank's årsoppgave.

🚗 Who is entitled to pendlerfradrag — a deduction for long-distance travel?

If you're one of the lucky people who has to travel more than 40 km to get to work, you can get 1.70 kr/km above the 77,000 km threshold (the current 'own contribution quota' is 14,000 kr). Let me give you an example to show you how it works. If you drive 18,400 km each year, then the cost to you is 31,280 kr minus 14,000 kr. That means you only pay 17,280 kr, which is about 3,800 kr less tax! I totally get it, electric cars get the same discount because it's based on kilometres, not fuel.

👶 How much can be deducted for childcare expenses (foreldrefradrag)?

Don't worry - the ceiling is 25,000 NOK for the first child, and just 15,000 NOK for each subsequent child up to 12 years of age. This includes barnehage, SFO, sports clubs, and school camps. Hey, just a heads-up: if your employer is covering the cost of those extracurricular activities through brutto-trekk, you might not be able to claim an additional deduction. It's just a friendly reminder to avoid double counting, and we're here to help you make the most of your benefits! The deduction is great news! It reduces the taxable base by 22%, which saves you 25,000 kr (≈ 5,500 kr).

💳 Will BSU still work in 2025, and how much will it save?

So BSU is this awesome account designed especially for young people under 34. It's called Boligsparing for Ungdom, and it's pretty cool. Hey, just so you know, if you make a contribution of up to NOK 27,500 per year, you'll get a 20% tax deduction (up to a max of NOK 5,500). We just want to make sure you're using the money for your first home, so please don't take out any more than you've been allowed. If you do, we'll just have to return the benefit to you, plus an extra 6% interest each year. Just so you know, when you buy a home, BSU contributions don't give you any benefits, but the interest on your account is higher than the market rate – about 5.65% per year.

🎁 Can donations be deducted and how much?

Oh, yes! You can reduce your tax bill by donating to registered organisations (gavefradrag) up to 25,000 NOK per year. It's so lovely to see how popular the Church, the Red Cross and Redd Barna are! Don't worry - the bank or Vipps will automatically let Skatteetaten know. But if you make a manual transfer, just make sure you get a kvittering. Just so you know, you can save up to 22% on 25,000, which works out to be a whopping 5,500 kr!

💼 What is important for a freelancer (enkeltpersonforetak)?

If you're self-employed, you'll be paying 11.2% in tax, plus an extra 22% - but don't worry, this is after the 'minimumsfradrag business' deduction. Just a friendly reminder to make those advance payments for 'skatt' (four times a year). Otherwise, you might be hit with a 10% + rentesats fine, which is obviously not ideal. I totally get it – the ENK-pensjon deduction is awesome because it lets you put off paying up to 7% of your income (up to 12G) tax-free! That means you'll be paying less tax overall in the year you file. Just a friendly reminder to keep your kvittering for five years, okay? The tax authorities often check freelancers, and it's just a friendly heads-up to make sure everything is in order!

📅 I'm just wondering when to expect the refund/additional tax payment in 2025?

In 2025, the vast majority of employees, 96% to be exact, will receive their decision between 26 March and 21 June. The rest of you will get yours by 24 October. If you get the thumbs-up on your Skattemelding by 15 March, you'll get your refund within 3-5 working days of the 'oppgjørsdato'. Don't worry - if you're paying less than NOK 1,000, you can just pay that in one go. And if you're paying more than NOK 1,000, don't fret, you can divide it into three instalments. The great news is that these instalments are interest-free, as long as you pay them on time!

⚖️ How can I avoid penalties for errors and use a frikort?

If you're new here and your yearly income is less than NOK 70,750, then you're in luck! You can apply for a frikort, which means you won't have to pay any tax. Don't worry if you go over the limit, there's no need to fret. The extra income will be taxed at 50% instead of the normal rate, but there are ways to avoid penalties. Just switch to a regular skattekort in good time and you'll be all set! I just want to let you know that if you don't report all your income, you'll be hit with a 20% penalty for 'underreporting' and a whopping 40% penalty for 'gross negligence'. Just a friendly reminder to always check the 'årsoppgave' from banks, NAV and employers before submitting your tax return.

Taxes in Norway are high, but the good news is that there are also many deductions: mortgage interest, after-school care, donations and even kilometres to work reduce the real rate to a comfortable 20-22%. Here are a few important steps to keep you on track:

- Please check your Skattekort code before February.

- Then, enter all fradrag in Skattemelding by 30 April.

Keep your receipts safe and set a reminder in your calendar for the skatteoppgjør date. Then you won't see the tax office as a scary thing, but as a friendly partner that'll help you out with that money so you can treat yourself to that trip to the fjords you've been dreaming of!

2 comments

Log in to leave a comment

Er det noen vanlige feil internasjonale besøkende gjør når det gjelder skatt, som man bør være ekstra oppmerksom på?

Når det gjelder foreldrefradraget, det er jo superpraktisk! 25 000 kr for første barn og 15 000 kr for de neste – det kan virkelig hjelpe med barnehage, fritidsaktiviteter og skoleleir. Jeg lurer litt på, hvordan folk holder oversikt over alle disse utgiftene for å sikre at de får fullt fradrag uten å gjøre feil?