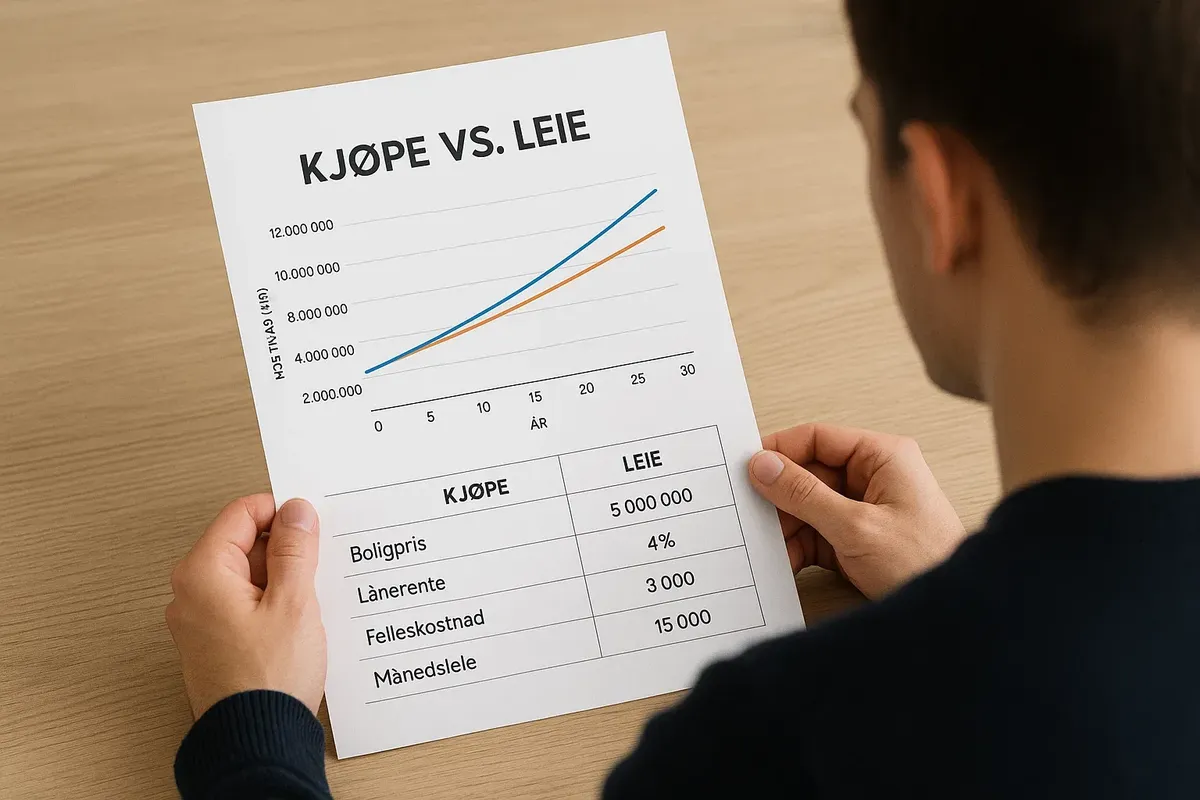

🏡 Buy or rent? Buying an apartment in Norway at a rate of 4.5% — when is it really worth it (analysis for 2025)

I know we all love a good mortgage rate update, so I'm delighted to tell you that the average mortgage interest rate in Norway has settled at around 4.5%. This is the highest it's been since 2011, so it's been a pretty exciting week all round! Some people think that with these figures, it might be better to just stay in rented accommodation. But others are sure that buying is still a great investment because of the growing market and tax deductions. We've put together a list of the most frequently asked questions, worked out the return on investment using real figures for 2025 for Oslo and Trondheim, and thought about everything, including felleskost, insurance, property tax and even the estate agent's commission on sale.

💰 How much equity do you need and how much will it eat into your liquidity?

The Norwegian rule of '85% belåningsgrad' is there to make sure you have a safety net in place, and it requires a minimum deposit of 15% of the property value, plus 2.5% for documents/notary fees. I totally understand that you're interested in buying an apartment in Oslo. The good news is that you'd be looking at spending 5,000,000 kr for the apartment, with 750,000 kr in cash and 125,000 kr in fees. Don't worry, this amount can't be taken from a regular consumer credit line. The bank will take the debt into account and reduce the maximum mortgage limit (5 times your annual income). Hey, so a lot of folks use a BSU account, and it's a great option! By the time you hit 30, the money you've saved in there (up to 300,000 kr) can actually save you a whopping 55,000 kr in taxes. And that's not all — it covers 6% of the initial payment too! It's really lovely that parents can give up to 1 million kr without having to pay gift tax, and this money goes towards balancing things out. Here's the best part: the higher your equity, the lower the rate (banks give -0.2 percentage points for 60% LTV), and the faster the apartment will pay for itself.

🧾 What does the monthly payment look like at 4.5% and what is hidden in the fee?

I'm so pleased to tell you that for a mortgage of 4,250,000 kr (5 million kr – 15%), the annuity at 4.5%/25 years is 23,600 kr/month. But wait, there's more! Add in the common costs, which are 3,200 kr in a 1960s Oslo neighbourhood or 2,100 kr in a new development. We're here to take care of all your needs, including the lift, heating, cable TV, lift maintenance and foundation maintenance. Some of our lovely borettslag pay for heating separately, which is great, but this means their felleskost goes up, although their strøm bill goes down. Hey, just so you know, Innboforsikring insurance is only 180 kr a month. I totally understand, the total monthly outflow is about 27,000 kr. For comparison, renting a similar three-room apartment costs 19,000–21,000 kr + electricity. I know the purchase price seems a bit higher at first, but the good news is that the payment includes debt repayment (around 9,000 kr in the first year), which means that the 'net expenses' are 18,000 kr. That's almost the same as rent, isn't it?

📉 I'm curious: could you tell me how the 22% tax deduction affects the real rate?

Don't worry - all your mortgage interest is deducted from the taxable base (alminnelig inntekt). I'm really pleased to tell you that the interest rate is just 4.5% on 4.25 million kr. That means that the first-year interest is about 189,000 kr. Hey, just so you know, the 22% deduction will give you a refund of 41,580 kr (which works out at 3,465 kr each month). The effective rate has dropped to 3.51%, which is great news! I'm happy to tell you that with an annuity, the 'cost of money' is reduced by 3,500 kr/month. It's easy to forget to think about this when you're using a calculator (Huseierne), isn't it? I totally understand if you're struggling to make ends meet. If your income is below 749,000 kr and you're already using the maximum other deductions (barnehage, BSU), you might lose part of the 'rentenfradrag'. Don't worry, though, just check your tax bracket limit and see what's available.

⚠️ How dangerous is the ‘risk element’ of a rate increase to 6%?

In 2024, Finanstilsynet asked banks to do some 'stress tests' on +3 percentage points to the rate. Hey, just so you know, when you pay 6%, it'll go up from 23,600 kr to 27,450 kr (+3,850 kr). SSB analysis shows that the median household cushion – 2.7 months of expenses – disappears at a rate of 6.2%. Hey, if you're thinking about having a little one or if your income is going to be a bit lower, why not take a look at fixing part of your loan (bunden rente)? A lot of banks offer a 3-year fixed rate of 4.95%, which can be really helpful. And finally, my dear, there's the 'servo' - a repayment holiday of up to 12 months! During this time, the bank will kindly transfer the payment to interest. This 'safety valve' protects the purchase from going bankrupt but extends the loan.

🔑 What are the benefits of renting, besides the flexibility it offers?

When you rent the property, the cost of most utilities is included. You are also covered for expensive, unexpected repairs. For example, if a pipe leaks, the owner will pay for the insurance and your own contribution. If there is a burst pipe in Oslo-Sagen, the apartment owner is liable for 50,000 kr to replace it. The cooperative divides the bill, so the tenant doesn't have to pay. The tenant can move if they find a job in Bergen, and they can end the contract by giving three months' notice. If you sell the apartment, you will have to pay a penalty. This penalty is 1.5% of the sale price to Megler and 2.5% to Dokumentavgift. This is included in the exit price. If you're planning to sell your property within the next 3-4 years, it's almost always cheaper to rent than to buy.

📈 How do you work out the price growth and rent indices to use in the 'buy vs. rent' model?

Between 2005 and 2025, the price of housing in Oslo went up by 5.9% every year, and rent went up by 3.1% according to the SSB index. If things continue the way they are, the apartment will be worth what you paid for it after nine years. But prices don't always go up in a straight line. From 2017 to 2019, prices went down by 5%. We suggest using a simple model: The value goes up by 3% every year, and the rent goes up by 2% every year. In this case, it takes 11 years to reach the break-even point. The good news is that you can rent out a room for free (up to 20,000 kr a year), which means you'll have to pay less yourself.

🏢 How will my mortgage rate be affected by the cooperative's fellesgjeld?

In a borettslag, part of the debt is held by the cooperative (fellesgjeld) and not by you personally. The bank looks at the 'total debt' when it calculates this. If the fellesgjeld is 1 million kr and your boliglån is 4.25 million kr, your debt ratio for Finanstilsynet will be at least 5 times your income. This can increase the rate by 0.1 percentage points and stop you getting more credit (for a car). Check theandel fellesgjeld (the amount shared by all owners). If it is more than 40% of the price, the best purchase calculation changes.

🏦 How much do the owners pay in taxes and fees each year?

The local tax on buildings in Oslo has been stopped for now, but in Bergen the rate is 3.8‰. This means that if you have an apartment worth 5 million kr, you will pay 19,000 kr a year. The shared costs (kommunal avgift) for water, sewerage and rubbish collection are 9,800 kr a year. These costs are only included in felleskost. When selling, you have to pay a document fee (dokumentavgift) of 2.5%. This is usually paid by the buyer, but it effectively reduces your price. If you have owned your property for more than one year and have lived there for more than 12 months in the last two years, you will not have to pay capital gains tax (kapitalgevinst). This is the main rule for speculators.

🔒 What does the 'hidden' loss of liquidity look like — depreciation versus investment?

The 9,000 kr per month that goes towards paying back the original loan cannot be spent. If you invest 5% of your money in bonds after tax, you'll have 580,000 kr. in your account after 5 years. The value of the property has decreased by 585,000 kr during this time, but it will only become available to be sold or refinanced. So buying is a good idea for people who are not afraid to 'freeze' their money — for example, freelancers who don't have a regular income.

✅ What are the best times to buy property instead of renting?

To sum up, an apartment costs 5 million kr, prices are going up by 3%, and rent starts at 19,000 kr and is going up by 2%. The interest rate is 4.5%, the deduction is 22%, the fees and insurance are 3,380 kr, and the taxes are 0. After eight years, the tenant will have paid ≈ 1,998,000 kr, and the owner will have received ≈ 2,140,000 kr. The apartment is worth 5.9 million kr more than before, but there is still 3.32 million kr of debt left. This means that the equity is 2.58 million kr. If you sell after paying a real estate agent's commission of 1.5%, you will make 2.49 million kr. The total capital paid out is 350,000 kr. If the term of ownership is less than six years, the curve is negative. If it is more than 10 years, buying is a good idea even with modest market growth.

A mortgage at 4.5% is neither a penalty nor a gain; it is simply the new reality of the market. If you buy property, you can make money for 10 years. You will have a stable income and a safety cushion. These are things that renting will never give you. But if you like to move around a lot, plan to move abroad or have not saved up a 15% deposit, renting is a good idea. It means you won't have to worry about interest rate changes and repairs. Do the maths: include shared costs, a 22% deduction, market growth and how long you want to hold the investment. This will help you make the right decision about whether to buy or rent, and will help you to save money for the future.

2 comments

Log in to leave a comment

Hva ville dere gjort i min situasjon — kjøpe nå med rente, eller vente og leie litt lenger? 🤔